How Good Are Credit Scores In These New York Cities?

With the arrival of spring, we're all coming out of the house and looking around our properties at all of the things we ignored during that long and weird winter we just wrapped up. If you're like most people in America, you're starting to get you're wrapping up your spring cleaning and getting your other to-do lists ready.

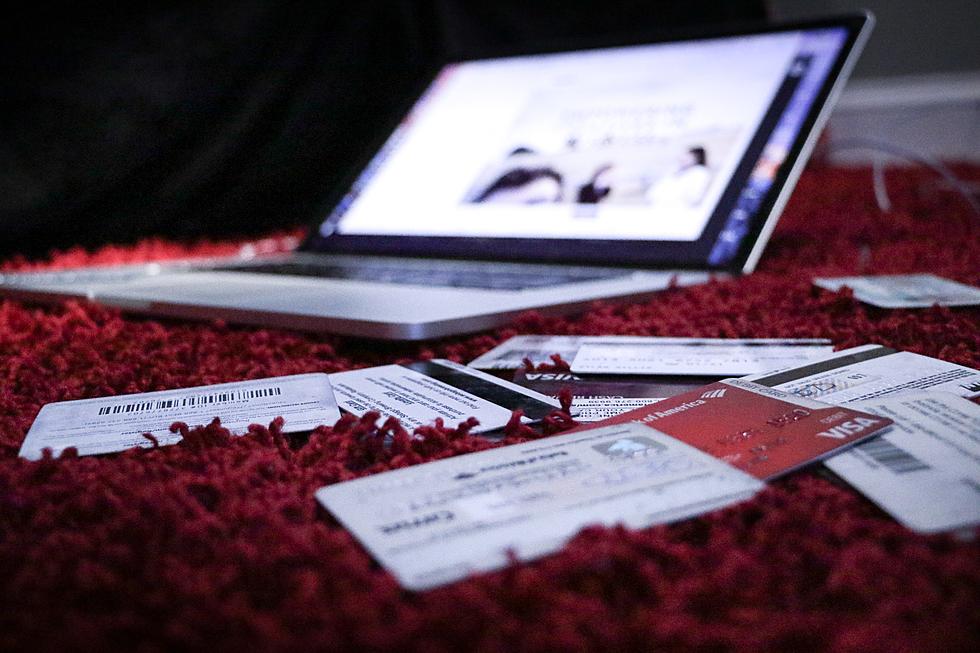

With all of the economic changes that we've seen over the last few years, coupled with the inflation that we're still dealing with, things are more expensive nowadays than they've ever been before in history. Those increases in prices are leading many people to need to rely on their credit more and more.

This of course means the benefit of having a good credit score is even more important than it ever has been before.

What Is A Credit Score

According to the Buffalo Urban League, a HUD Approved Housing Counseling Agency in Buffalo, a credit score is a 3-digit number that is used to quickly describe the history or record of how a person has managed their financial liabilities in the past, based on data that is in their credit report and can range from 350 on the low end, to 850 on the high end.

There are all sorts of different types and styles of credit scores, the most popular of which are offered by a FICO and VantageScore.

Since the score is meant to represent how well someone manages their debts, the higher the number the better off you are.

How Good or Bad Are Credit Scores In New York

Being that New York State is the financial capital of America, and essentially the whole world, you would think that credit scores in the Empire State would be pretty good.

WalletHub obtained disaggregated credit data from TransUnion and was able to analyze credit scores from more than 2,500 cities in America and the results are pretty surprising.

Only one location from New York appears in the top 25 and it's not the city you think.

Where Does Buffalo Credit Scores Rank?

Pittsford, a Rochester suburb, holds the best credit scores in New York State with a median score of 784.5. That puts Pittsford in 10th place and among the 99th percentile of scores nationwide. Bay Shore in Long Island has the worse scores in New York with a median score of 547.5. That puts them in 2560th place, out of a total of 2,568.

Buffalo is in 1,919th place with a median credit score of 675.

You can check out the entire report here.

6 Tips To Survive 'Record Inflation' in New York

Unique Triangle House In Buffalo For Sale

10 Summertime Restaurants in WNY That Deserve Way More Credit

More From 93.7 WBLK